When it comes to tax season, one of the most important forms that individuals need to fill out is the Form 1040. This form is used to report income, claim deductions, and calculate their tax liability. It is a crucial document that every taxpayer has to complete accurately and submit to the Internal Revenue Service (IRS).

Form 1040: A Comprehensive Guide

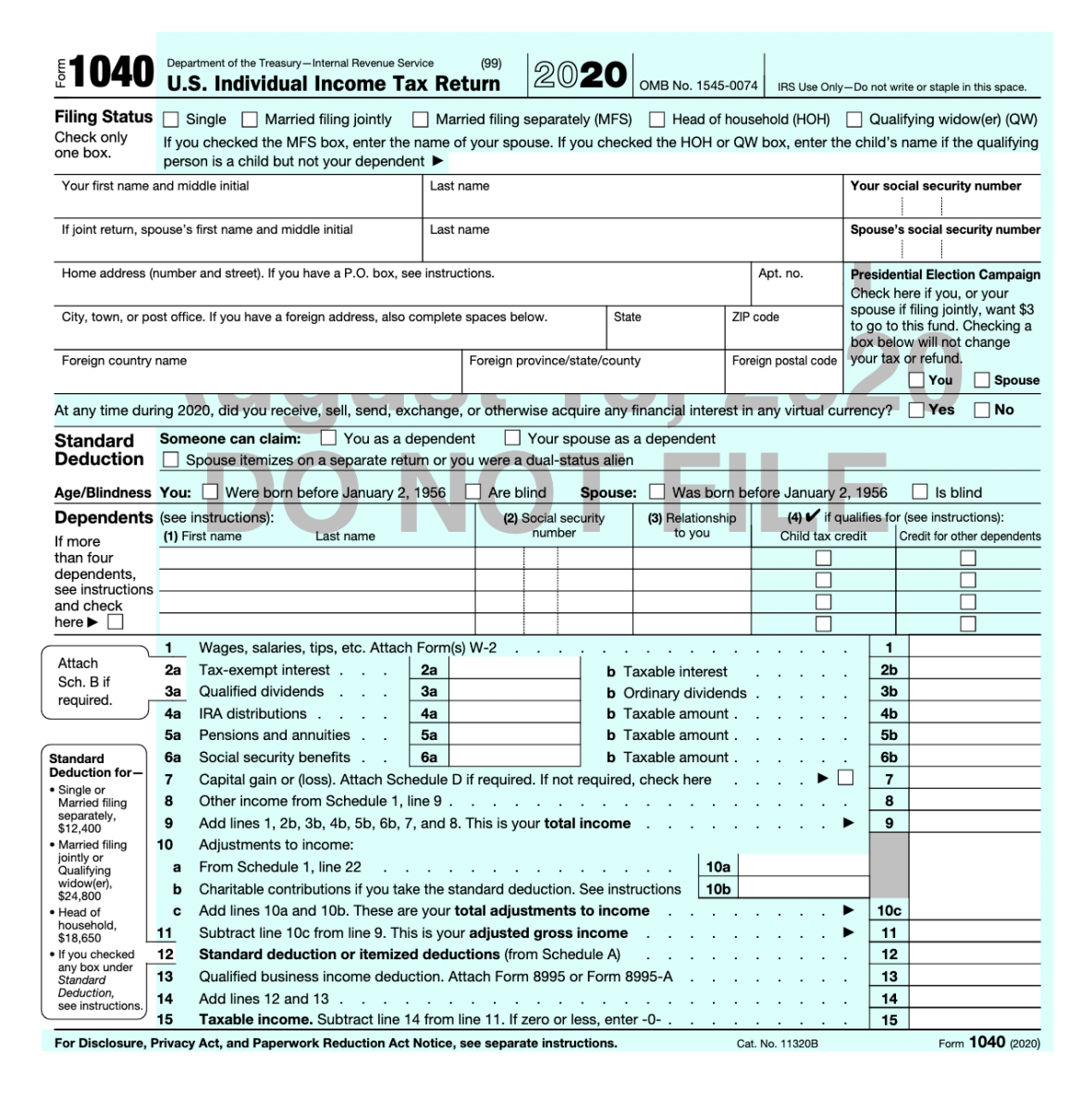

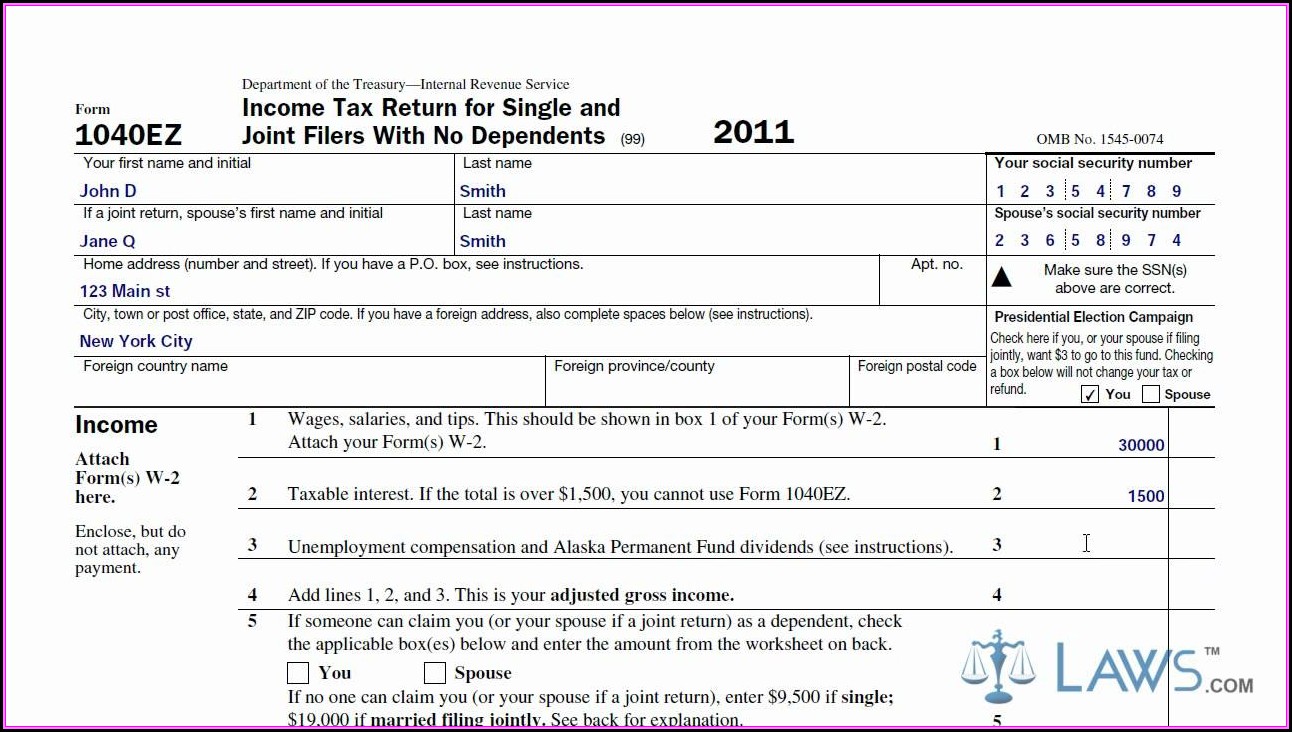

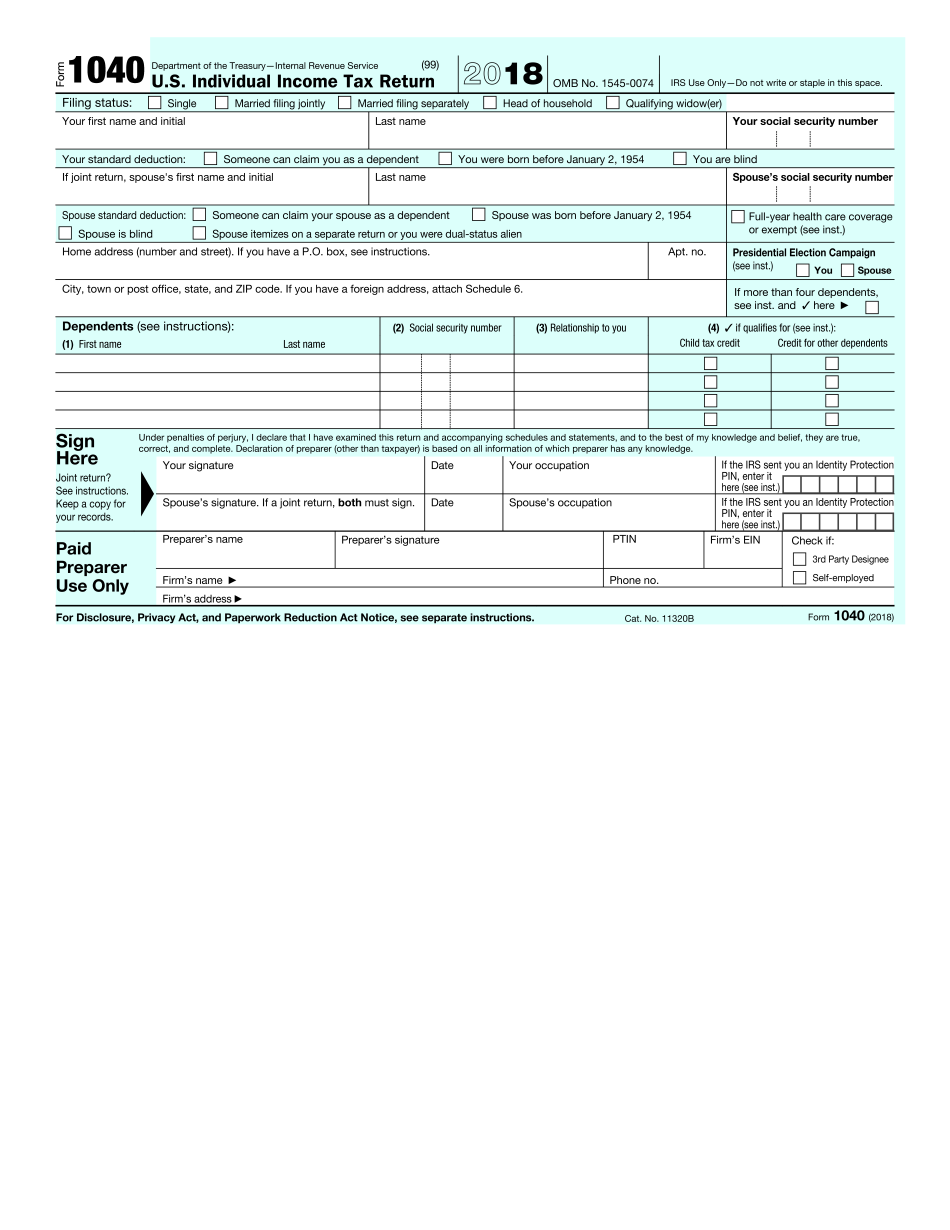

Form 1040, also known as the “U.S. Individual Income Tax Return,” is the primary form used by taxpayers to report their annual income and pay their federal taxes. The form consists of various sections, each addressing different aspects of an individual’s tax situation.

The form starts with basic personal information such as name, address, and Social Security number. It then moves on to gather information about sources of income, including wages, self-employment income, rental income, and more. Deductions and credits are also factored into the form, allowing taxpayers to potentially lower their tax liability.

The form starts with basic personal information such as name, address, and Social Security number. It then moves on to gather information about sources of income, including wages, self-employment income, rental income, and more. Deductions and credits are also factored into the form, allowing taxpayers to potentially lower their tax liability.

Additional Schedules and Forms

In some cases, individuals may need to include additional schedules or forms along with their Form 1040. These additional documents provide more detailed information about specific types of income, deductions, or credits. One such example is Schedule 8812, used to claim the Additional Child Tax Credit.

Additionally, taxpayers may need to file an amended return if they made errors in their original submission. Form IL-1040-X, specific to individual income tax returns in Illinois, is used to correct any mistakes on a previously filed Form IL-1040.

Additionally, taxpayers may need to file an amended return if they made errors in their original submission. Form IL-1040-X, specific to individual income tax returns in Illinois, is used to correct any mistakes on a previously filed Form IL-1040.

Benefits of Form 1040

Benefits of Form 1040

One of the benefits of using Form 1040 is that it allows individuals to take advantage of various deductions and tax credits to reduce their overall tax liability. For example, taxpayers can claim deductions for mortgage interest, student loan interest, and medical expenses, among others.

Moreover, the form provides a clear structure that helps individuals organize their financial information. By following the instructions provided, taxpayers can ensure that they include all the necessary details and calculations required by the IRS.

Moreover, the form provides a clear structure that helps individuals organize their financial information. By following the instructions provided, taxpayers can ensure that they include all the necessary details and calculations required by the IRS.

Filing Options

While filling out Form 1040 manually is an option, taxpayers also have the opportunity to file their taxes electronically. The IRS provides an online platform where individuals can submit their tax returns electronically, reducing the chances of errors and speeding up the processing time.

An increasingly popular method is to use tax preparation software that walks individuals through the entire process, ensuring they don’t miss any crucial steps or information. These software programs make it easier for taxpayers to complete their tax returns accurately and efficiently, regardless of their tax knowledge.

An increasingly popular method is to use tax preparation software that walks individuals through the entire process, ensuring they don’t miss any crucial steps or information. These software programs make it easier for taxpayers to complete their tax returns accurately and efficiently, regardless of their tax knowledge.

In conclusion, Form 1040 is a vital document for individuals to fulfill their tax obligations. It enables taxpayers to report their income, claim deductions, and pay their taxes accurately. By understanding the various sections of the form and utilizing additional schedules or forms if necessary, individuals can navigate through the tax-filing process with confidence.