A tax deduction is a valuable tool that can help small businesses reduce their taxable income and ultimately save money on their tax bills. By knowing and taking advantage of the various tax deductions available, business owners can maximize their tax savings and keep more money in their pockets.

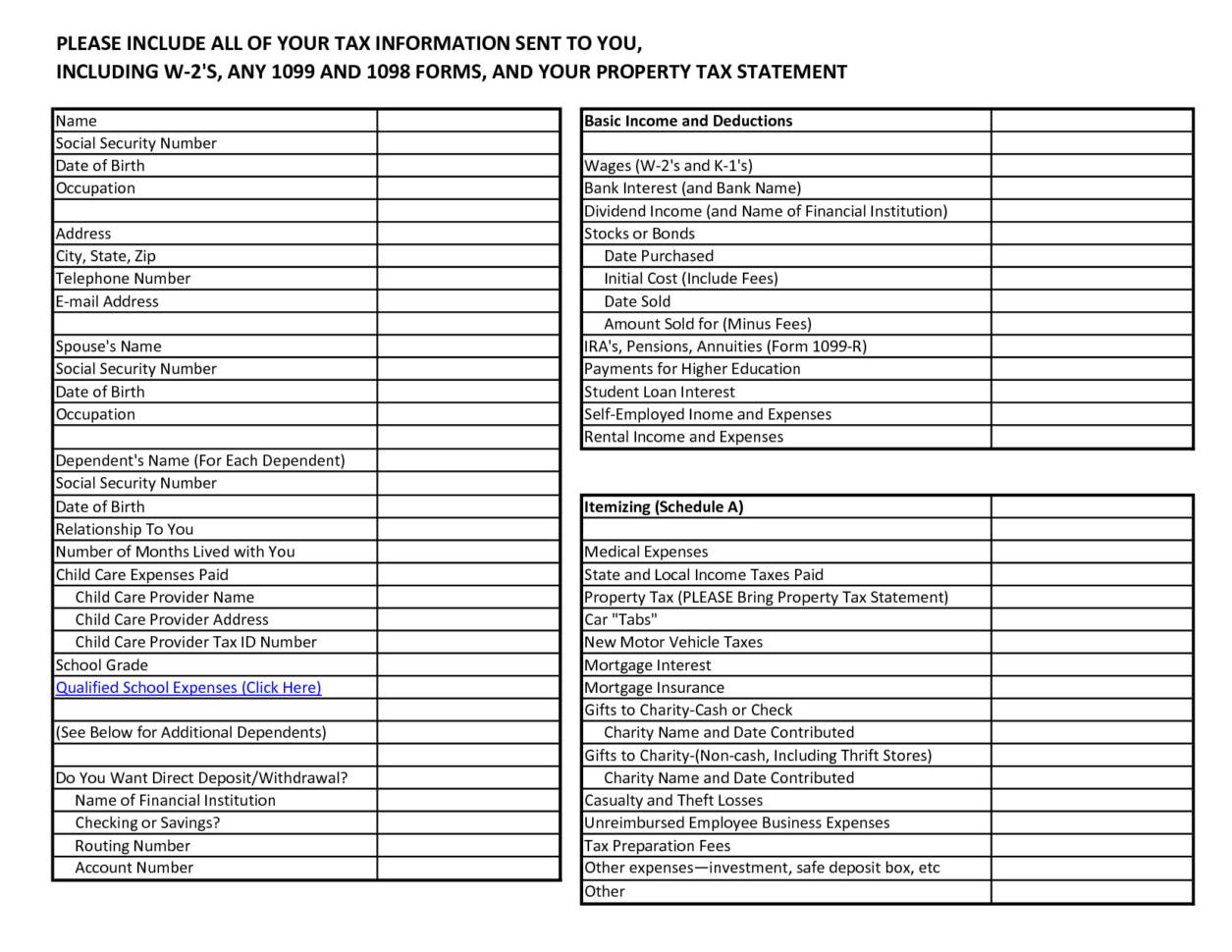

One important tool for small business owners is a tax deduction worksheet. This worksheet provides a comprehensive list of potential deductions that a business may be eligible for. By keeping track of these deductions throughout the year, business owners can ensure that they are not missing out on any potential tax savings.

Another useful resource for small business owners is a tax preparation spreadsheet. This spreadsheet can help business owners organize their expenses and calculate their potential deductions in a systematic manner. By having all the necessary information in one place, business owners can simplify the tax preparation process and ensure that they are not missing out on any deductions.

For small business owners who run their businesses from home, there are also specific deductions that they may be eligible for. These deductions can include expenses such as home office expenses, utilities, and even a portion of the homeowner’s insurance. By understanding and taking advantage of these deductions, home-based business owners can save on their tax bills.

When it comes to tax deductions, it is important for small business owners to keep detailed records and documentation. A business tax worksheet can help with this task by providing a structured format for recording and organizing expenses. By using a worksheet, business owners can ensure that they have all the necessary information to support their deductions in case of an audit.

There are numerous tax deductions available to small businesses, and it can be overwhelming to keep track of them all. That’s where a business tax deductions worksheet can come in handy. This worksheet provides a checklist of potential deductions that business owners can use to ensure they are not missing out on any tax savings.

When it comes to tax preparation, a spreadsheet can be a valuable tool. This spreadsheet can be used to organize all the necessary information for preparing and filing taxes, including income, expenses, and potential deductions. By using a spreadsheet, small business owners can ensure that they have accurate and up-to-date information for their tax filings.

A small business tax deductions worksheet is not complete without a section for miscellaneous deductions. This section allows business owners to include any additional deductions that may apply to their specific situation. By including these deductions, small business owners can potentially save even more on their tax bills.

Business owners who are looking for a comprehensive guide to tax deductions can turn to the IRS. The IRS provides a variety of resources, including business worksheets, that can help small business owners understand and navigate the complex world of tax deductions. By utilizing these resources, business owners can ensure that they are taking advantage of all the tax savings available to them.

Real estate agents have their own unique set of deductions that they may be eligible for. Expenses such as advertising, mileage, and licensing fees can all be deducted from their taxable income. By keeping track of these expenses and utilizing a tax deductions checklist, real estate agents can ensure that they are maximizing their tax savings.

Finally, business owners can refer to a printable checklist of 100 tax deductions to ensure that they are not missing out on any potential deductions. This checklist provides a comprehensive list of deductions that business owners can use as a reference to identify potential tax savings. By using this checklist, business owners can have confidence that they are claiming all the deductions they are entitled to.

In conclusion, tax deductions can be a valuable tool for small business owners to reduce their taxable income and save money on their tax bills. By utilizing resources such as tax deduction worksheets, tax preparation spreadsheets, and checklists, business owners can ensure that they are taking advantage of all the deductions available to them. By keeping accurate records and documenting their expenses, small business owners can maximize their tax savings and keep more money in their pockets.+