It’s that time of year again when we all gather our documents, crunch the numbers, and fill out our income tax returns. While the process can be a bit daunting, especially if there are any amendments to be made, there are resources available to help make it a little easier. In this post, we’re going to take a look at the Form 1040X, a document that allows individuals to amend their U.S. individual income tax return.

What is the Form 1040X?

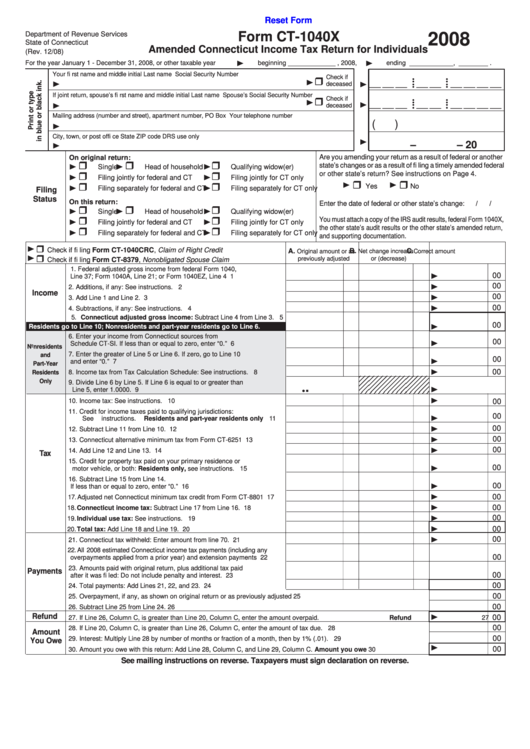

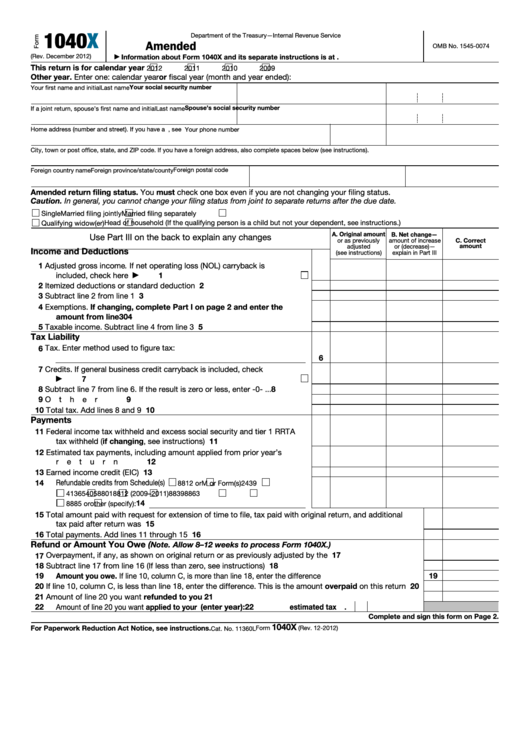

The Form 1040X, officially known as the Amended U.S. Individual Income Tax Return, is a tool provided by the Internal Revenue Service (IRS) that allows taxpayers to correct any errors or make changes to their original tax return. It is important to note that the Form 1040X can only be used to amend previously filed Forms 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

The Form 1040X, officially known as the Amended U.S. Individual Income Tax Return, is a tool provided by the Internal Revenue Service (IRS) that allows taxpayers to correct any errors or make changes to their original tax return. It is important to note that the Form 1040X can only be used to amend previously filed Forms 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

How to Fill Out the Form 1040X?

Filling out the Form 1040X may seem intimidating at first, but it’s not as complicated as it may seem. When completing the form, you will need to provide your personal information, such as your name, Social Security number, and address. You will also need to explain the changes you are making and the reasons for those changes. The form provides specific sections to report any adjustments to your income, deductions, credits, and payments.

Filling out the Form 1040X may seem intimidating at first, but it’s not as complicated as it may seem. When completing the form, you will need to provide your personal information, such as your name, Social Security number, and address. You will also need to explain the changes you are making and the reasons for those changes. The form provides specific sections to report any adjustments to your income, deductions, credits, and payments.

Additionally, you will need to attach any supporting documentation that is relevant to the changes you are making. This can include copies of W-2 forms, 1099 forms, or any other documents that support your amended return. It’s important to keep in mind that the IRS may request additional information or documentation if necessary.

Why Would I Need to Amend My Tax Return?

There are a variety of reasons why you might need to amend your tax return. Some common scenarios include:

There are a variety of reasons why you might need to amend your tax return. Some common scenarios include:

- Discovering errors or mistakes on your original tax return, such as incorrect income or deductions

- Receiving additional forms, such as a corrected W-2 or 1099

- Not claiming credits or deductions that you were eligible for

- Changing your filing status

It’s important to note that if you are amending your return to claim an additional refund, you will need to do so within three years of the original filing date or within two years of paying the tax, whichever is later.

Where Can I Find the Form 1040X?

The Form 1040X can be obtained from various sources. You can download a fillable PDF version of the form from reputable websites such as FormsBank, TemplateRoller, or the official IRS website. Always ensure that you are using the most up-to-date version of the form, as it may change from year to year. The form comes with detailed instructions that you may find helpful when filling it out.

The Form 1040X can be obtained from various sources. You can download a fillable PDF version of the form from reputable websites such as FormsBank, TemplateRoller, or the official IRS website. Always ensure that you are using the most up-to-date version of the form, as it may change from year to year. The form comes with detailed instructions that you may find helpful when filling it out.

The process of amending your tax return may seem overwhelming, but with the help of the Form 1040X and a little patience, you can successfully make any necessary changes. Remember, it’s always best to consult with a tax professional if you have any questions or concerns regarding your specific situation. Happy filing!