Today, I want to talk about a very important document that often goes overlooked but is essential for various financial transactions. It’s called the W9 form, and if you haven’t heard of it before, don’t worry, I’m here to give you all the details. So let’s dive right in!

What is a W9 Form?

The W9 form is an IRS document that is used to collect information from individuals or entities who provide services to businesses. It stands for “Request for Taxpayer Identification Number and Certification.” In simple terms, it is a way for the IRS to verify the taxpayer’s identification and ensure that they are paying the correct amount of taxes.

The form requires the individual or entity to provide their name, address, and taxpayer identification number (TIN). The TIN can either be a Social Security number (SSN) or an employer identification number (EIN) for businesses. This information is crucial for the business to accurately report income paid to the individual or entity to the IRS.

The W9 form is not directly submitted to the IRS. Instead, it is used as a reference by individuals or businesses that need to report payments made to the taxpayer. For example, if you are a freelancer or an independent contractor, your clients may ask you to fill out a W9 form so that they can report the payments they made to you on Form 1099-MISC.

Why is the W9 Form Important?

The W9 form is important for both the taxpayer and the business requesting it. Here’s why:

For the Taxpayer:

By providing the requested information on the W9 form, taxpayers ensure that they are correctly identified by the IRS. This helps in avoiding any discrepancies or issues that may arise during tax filing season. It also ensures that the taxpayer receives any necessary tax documents, such as Form 1099-MISC, in a timely manner.

Additionally, it’s crucial for taxpayers to provide their correct TIN to prevent any backup withholding from their income. If a taxpayer fails to provide a TIN or provides an incorrect one, the business making the payment may be required to withhold a portion of the payment and remit it to the IRS.

Overall, the accurate completion of the W9 form helps the taxpayer maintain compliance with tax laws and regulations while ensuring that their income is reported correctly.

For the Business:

On the other side, businesses need the W9 form to fulfill their tax reporting obligations. By collecting the necessary information, they can accurately report payments made to the taxpayer on Form 1099-MISC. This helps the business in avoiding any penalties or fines that may result from incorrect reporting.

Furthermore, having the W9 form on file allows businesses to easily contact the taxpayer if any issues arise regarding the accuracy of the reported information. It provides a reliable source of contact information, ensuring smooth communication and resolution of any potential problems.

In summary, the W9 form serves as a vital link between taxpayers and businesses, facilitating accurate reporting and smooth financial transactions. It’s crucial for both parties to understand its purpose and complete it correctly.

Where can I find a Printable Blank W9 Form?

If you’re in need of a printable blank W9 form, you’re in luck! There are many sources online where you can find and download the form for free. Here are a few websites where you can find a printable blank W9 form:

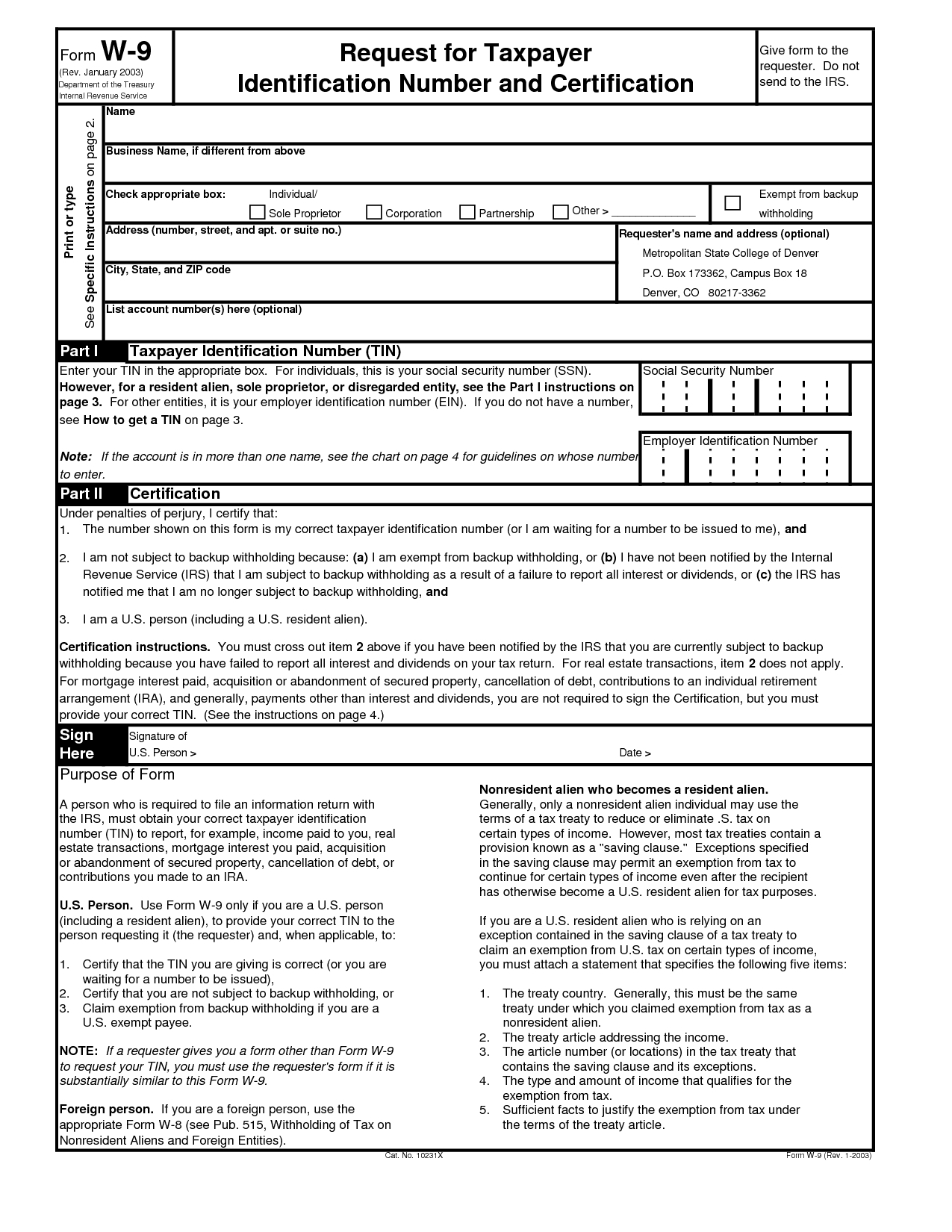

Website 1: Calendar Template Printable

This website offers a printable blank W9 form that you can easily download and fill out. It provides a convenient template that includes all the necessary fields, making it simple for you to complete the form accurately.

This website offers a printable blank W9 form that you can easily download and fill out. It provides a convenient template that includes all the necessary fields, making it simple for you to complete the form accurately.

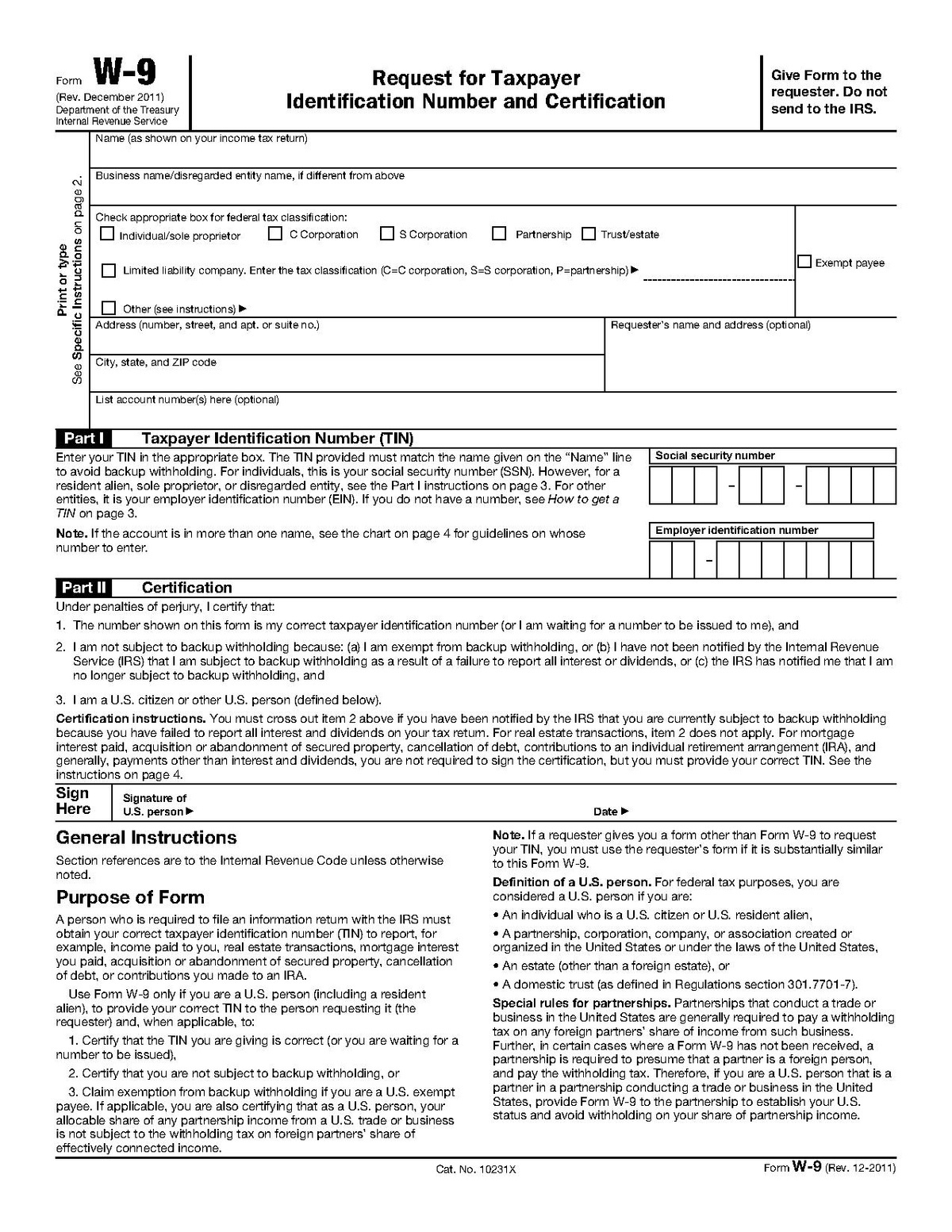

Website 2: Free PrintableHQ

Here, you’ll find a printable W9 form for the years 2018-2019. This website offers a straightforward template that allows you to enter your information easily. Simply download the form and start filling it out to ensure that you have a completed W9 form ready for any business transactions.

Here, you’ll find a printable W9 form for the years 2018-2019. This website offers a straightforward template that allows you to enter your information easily. Simply download the form and start filling it out to ensure that you have a completed W9 form ready for any business transactions.

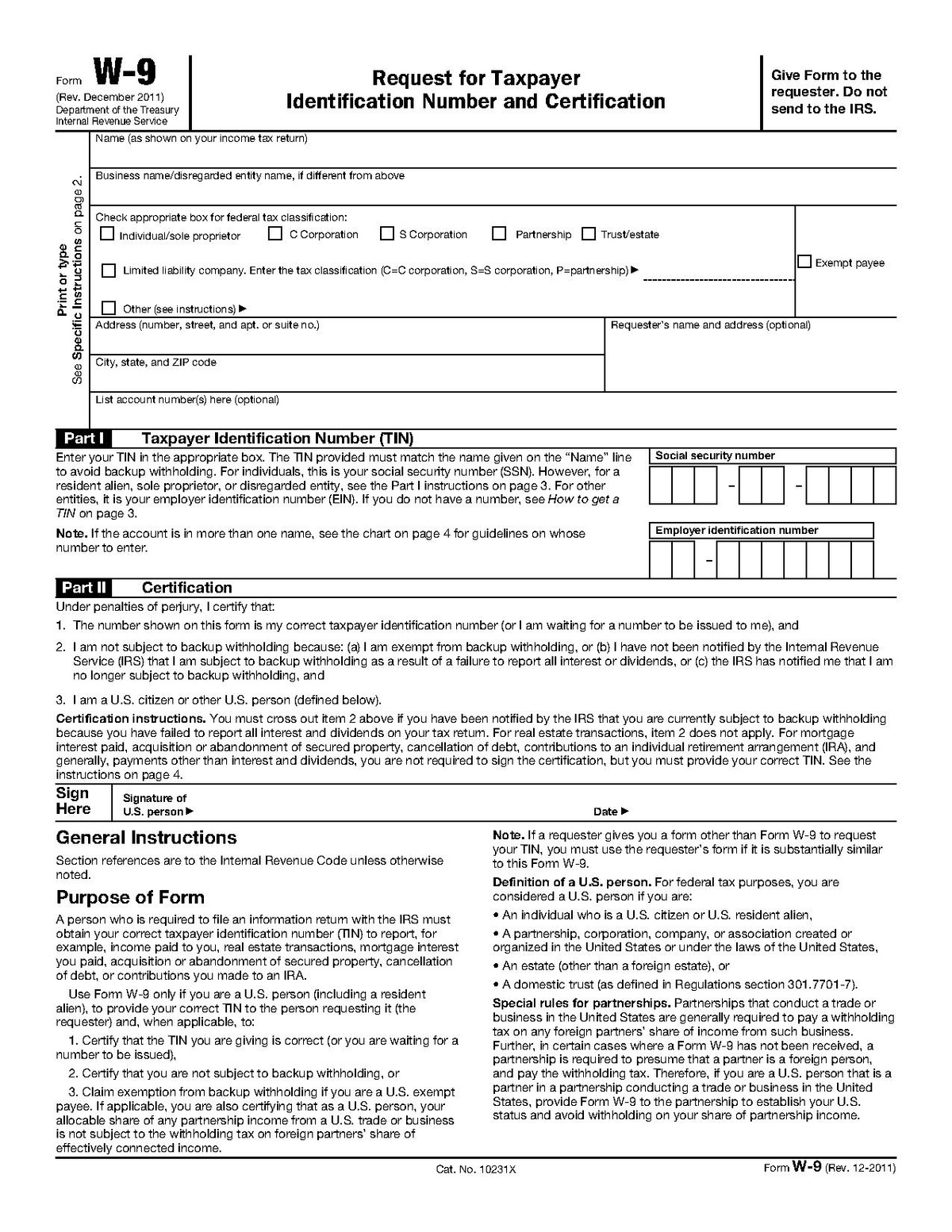

Website 3: PapersPanda.com

PapersPanda.com provides a printable W9 tax form that you can use for your tax-related documentation needs. The template is user-friendly and includes clear instructions, ensuring that you complete the form accurately and efficiently.

PapersPanda.com provides a printable W9 tax form that you can use for your tax-related documentation needs. The template is user-friendly and includes clear instructions, ensuring that you complete the form accurately and efficiently.

Website 4: Free Printable For You

This website offers a free printable W9 form that you can download and print without any hassle. The template is clean and easy to follow, allowing you to complete the form quickly and accurately.

This website offers a free printable W9 form that you can download and print without any hassle. The template is clean and easy to follow, allowing you to complete the form quickly and accurately.

These are just a few examples of websites where you can find printable blank W9 forms. Remember, it’s crucial to use a reliable source when obtaining such important documents. Always double-check the information you enter on the form to ensure its accuracy and completeness.

Conclusion

The W9 form may seem like a small piece of paperwork, but it plays a significant role in maintaining accurate tax records and ensuring smooth business transactions. Both taxpayers and businesses must understand the importance of this form and complete it correctly. So, the next time you’re asked to provide a W9 form, you’ll know exactly what it’s for and where to find a printable version online!